Stack Coin Age model

- Overview

- Introduction

- Bitcoin UTXOs and coin age

- Account-based blockchains

- The stack coin age model

- Acknowledgments

- References

Overview

Introduction

Blockchain data gives us a unique opportunity to perform novel economic research. There have been several metrics developed for Bitcoin that exploit the availability of onchain data and show us a picture of the Bitcoin economy which is impossible to get in the fiat world.

These include:

- Bitcoin-days destroyed;

- Аge distribution (also known as HODL waves);

- Realized capitalization.

Those metrics are Bitcoin-specific, because they rely on the UTXO model and its natural way of defining the age of a given coin.

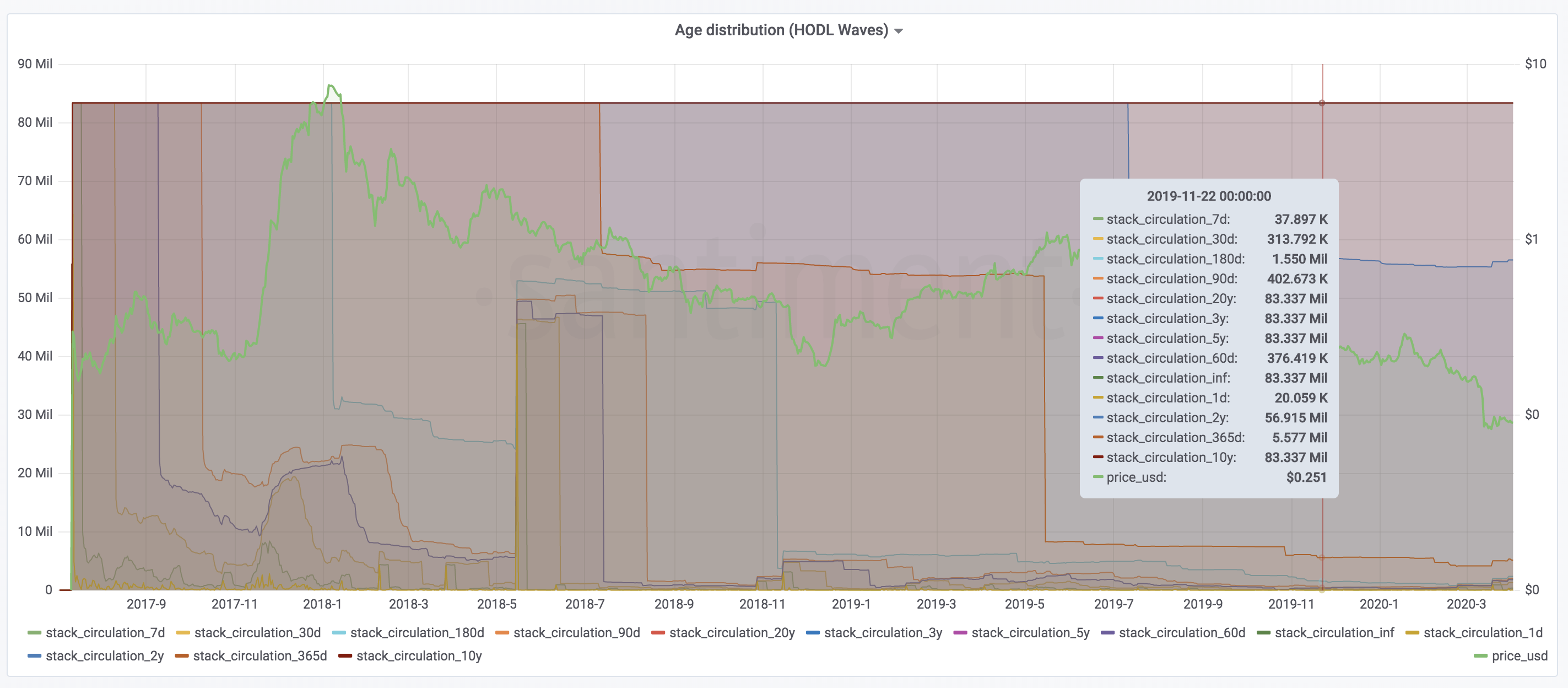

At Santiment we have managed to extend these metrics to account-based blockchains like Ethereum. To achieve that, we have developed an alternative notion of age which can be applied to virtually any blockchain. As an example, here's the coin age distribution for our own SAN token:

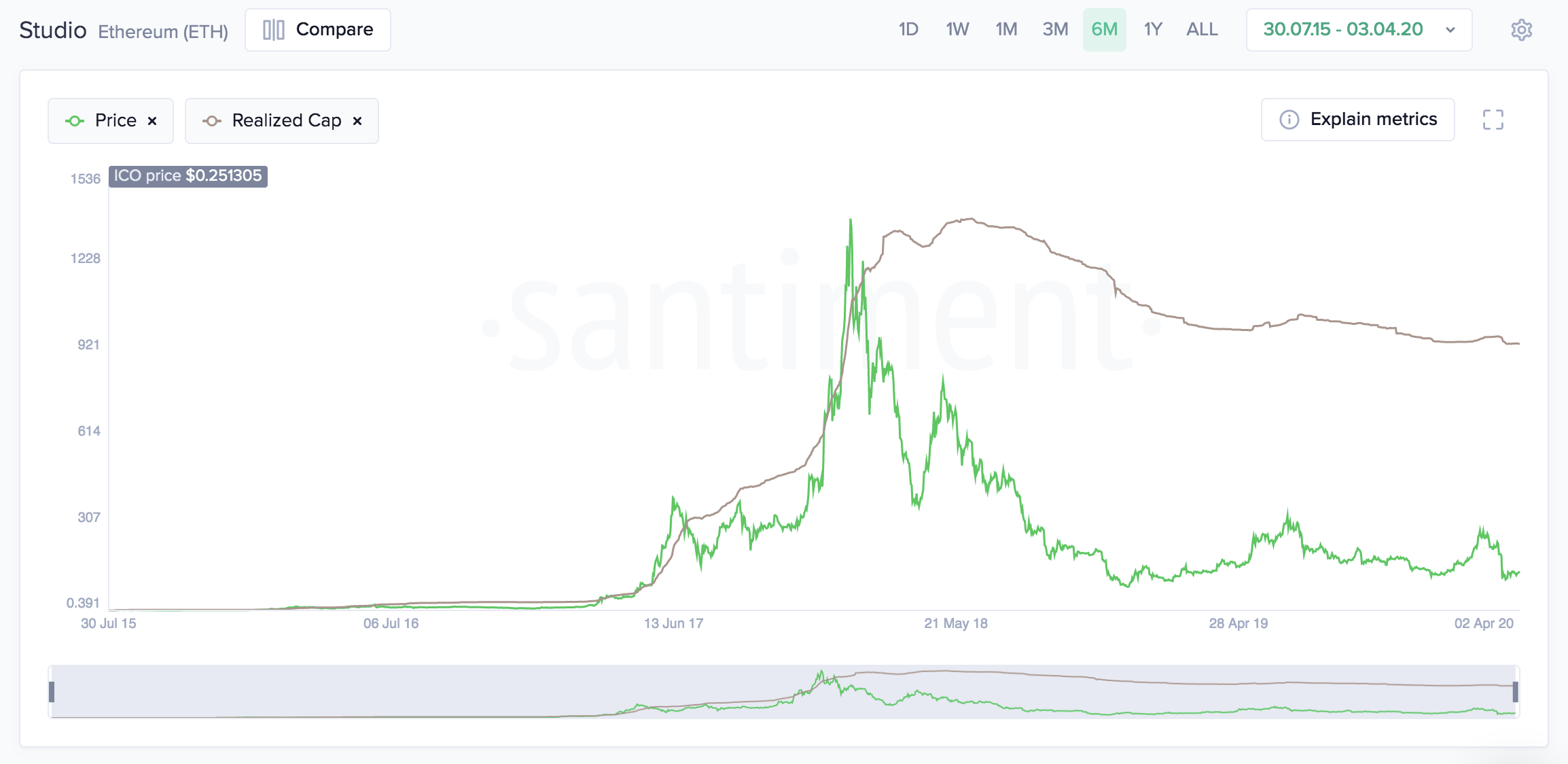

and here is the realized cap for Ethereum:

In this article we want to describe how exactly we generalize the above-mentioned metrics. They are all based on the notion of coin age, which measures how long a given coin has stayed in a given wallet.

Bitcoin and other UTXO-based blockchains give us a natural way of defining coin age. While this definition is natural, it is based on technical details and is not really related to any economic properties of the blockchain.

We are going to propose a different coin age model, which we call stack-based coin age. Our custom model actually has financial justifications, and can easily be applied to any blockchain.

This article covers a technical subject. We've written several articles (and will publish many more in the future) explaining what Santiment metrics actually tell us about different types of behavior of market participants.

Bitcoin UTXOs and coin age

The Bitcoin blockchain uses the so-called UTXO model for keeping track of coins. UTXO stands for "Unspent Transaction Output".

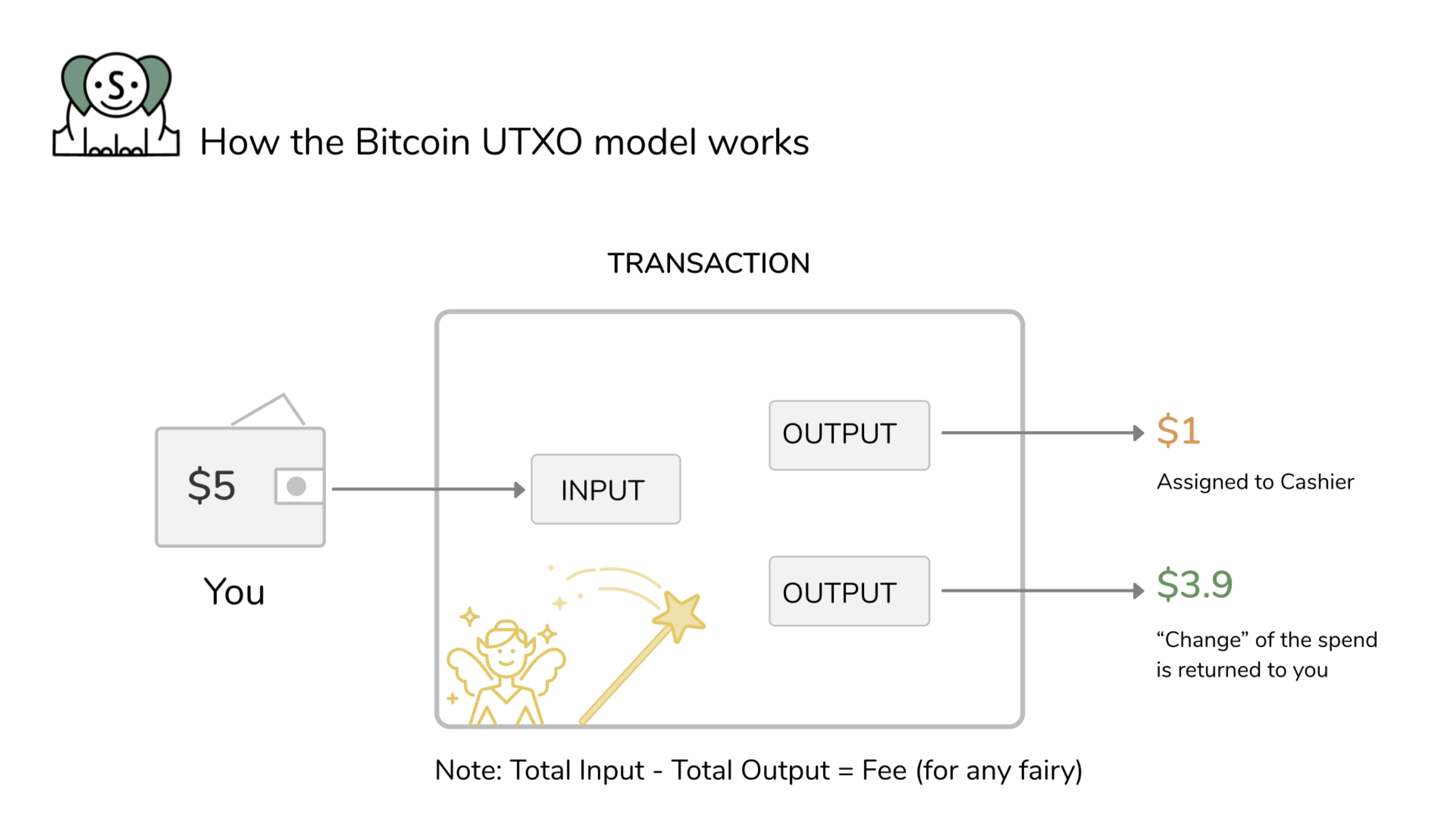

Each Bitcoin address holds of a bunch of outputs; each output contains a certain amount of coins. A Bitcoin transaction consists of a list of old outputs that are going to be destroyed or spent, and a list of new outputs that are going to be created. The total amount of coins in the spent outputs must be greater or equal to the total amount of coins in the new outputs. The difference between the amounts is sent to the miner that creates the block.

In a way, the UTXO model resembles paper money. You can think of your Bitcoin address as a wallet and of the unspent outputs as the coins and notes in the wallet. There is one small difference normal coins do not get destroyed in transactions.

But imagine the following fantastical scenario. You have a $5 note in your wallet and you want to buy bread for $1. When you give your note to the cashier, it gets incinerated and two brand new notes appear out of thin air. One $1 note goes to the cashier and another $3.90 note is put back to your wallet. 10 cents go to a magical fairy that just performed this operation. This is, in essence, how the Bitcoin UTXO model works.

You can assign an age to each

note or coin in your wallet which would simply tell you how long it stayed

there. Let's say that the $5 note in our example was taken from an ATM machine

on January 1st and you used it to buy bread on February 1st. At the time of

purchase, then, the age of this particular $5 note would be 31 days. When you

spend the note you "destroy" $31*5=155$ dollar-days.

You can assign an age to each

note or coin in your wallet which would simply tell you how long it stayed

there. Let's say that the $5 note in our example was taken from an ATM machine

on January 1st and you used it to buy bread on February 1st. At the time of

purchase, then, the age of this particular $5 note would be 31 days. When you

spend the note you "destroy" $31*5=155$ dollar-days.

In the UTXO model, similarly, we can associate an age to each output using the time when the output was created. More importantly, we get a canonical way to associate an age to each satoshi, because each satoshi currently in existence belongs to a given unspent output.

This notion of coin age is what allows us to define the metrics that we described above. To compute Bitcoin-days destroyed, we take all Bitcoins spent at any given time and multiply each by its age to arrive at the total. The age distribution metrics show us how many Bitcoins have a given age at a given point in time. The realized capitalization gives us the total cost of acquisition; in other words, for each existing satoshi we take its dollar price at the time when it was created and sum those together.

Bitcoin transactions explained You can assign an age to each note or coin in your wallet which would simply tell you how long it stayed there. Let’s say that the $5 note in our example was taken from an ATM machine on January 1st and you used it to buy bread on February 1st. At the time of purchase, then, the age of this particular $5 note would be 31 days. When you spend the note you “destroy” 31 ∗ 5 = 155 dollar-days.

In the UTXO model, similarly, we can associate an age to each output using the time when the output was created. More importantly, we get a canonical way to associate an age to each satoshi, because each satoshi currently in existence belongs to a given unspent output.

This notion of coin age is what allows us to define the metrics that we described above. To compute Bitcoin-days destroyed, we take all Bitcoins spent at any given time and multiply each by its age to arrive at the total. The age distribution metrics show us how many Bitcoins have a given age at a given point in time. The realized capitalization gives us the total cost of acquisition; in other words, for each existing satoshi we take its dollar price at the time when it was created and sum those together.

Account-based blockchains

If we want to develop similar metrics for Ethereum and other blockchains, we first have to figure out how to define coin age for them. Unlike Bitcoin, however, Ethereum uses an account model. What this means is that, instead of many outputs, to each address we associate just a single number, which represents its balance. When we move coins between addresses, those balances get updated.

The account model is very similar to the way a traditional bank account works. Imagine again that you go to buy bread for $1, except this time you are using your debit card.

Let's say that your bank account has $100, and the baker's bank account has $200. You give your debit card to the cashier, they swipe it and give it back. As the card gets swiped, your account balance changes to $98.90 and the baker's account balance changes to $201. Again, 10 cents are paid as a transaction fee.

Here's the question what is the age of the money currently sitting in your bank account? Let's say that you received one transfer of $50 on December 1st and another transfer of $50 on January 1st. When you spent one dollar for bread (again on February 1st) which dollar did you spend? Did you take one of the dollars that you received in December, or one of the dollars you got in January? Or maybe you took 50 cents from December and 50 cents from January? In each of these scenarios, the age of the spent dollar, as well as the age of the remaining money in your account, would be different.

We can see that for account-based assets, there is no canonical way to associate coin age.

Let's think again about the Bitcoin coin age. We showed how we associate age to coins using unspent outputs and how we use that data to define various metrics. It turns out that those metrics can give us valuable information about the overall Bitcoin economy. But the coin age model that we used to derive those metrics has no intrinsic economic meaning! When studying the fiat economy, it doesn't really matter which note we choose to pay for bread, if we have several notes in our wallet.

Similarly, when you make a Bitcoin transaction you or rather your Bitcoin wallet software choose which unspent outputs to use to make that transaction. Your choice affects the coin ages, yes, but from an economic point of view -- your choice is entirely irrelevant.

We have managed to derive valuable metrics of Bitcoin's economy from a notion of coin age, which, economically speaking, is essentially arbitrary. Any other reasonable way to assign coin age which works for all assets would be at least as valid. Hence we can expect that metrics derived from alternative coin age models will expose the same information about the assets' economy.

The stack coin age model

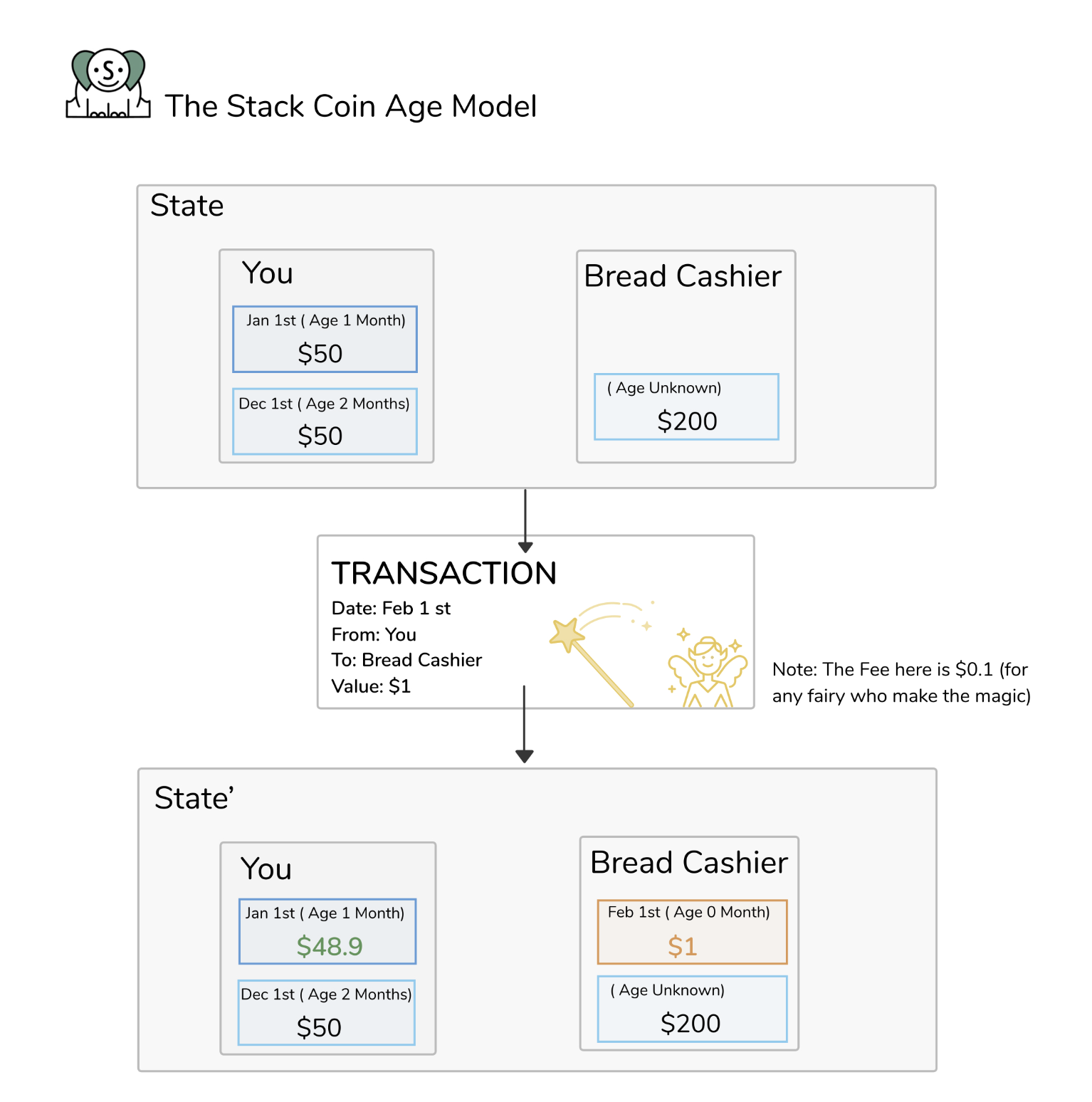

So let's invent a better model. Let's go back to the buying bread example and decide to abide by the following rule when I pay in cash I always choose the most recent coins and notes that I have in my wallet to pay the cashier.

I can easily follow this rule with notes and coins, but I can also pretend to follow it when I pay with a debit card. If I have received $50 on December 1st and another $50 on January 1st, I will pretend that when I buy bread on February 1st, I use the $1 coming from the most recent transfer.

This allows me to assign ages again. Before I bought the bread, I had $50 whose age was 2 months and $50 whose age was 1 month. In my transaction I spent $1.1 (one dollar to the cashier and a 10p fee) whose age was one month (which destroyed $31*1.1=34.1 dollar-days). After that I am left with $50 with an age of 2 months and $48.9 with an age of 1 month.

By making this choice, we imagine that our account is like a stack when money comes in, it is put on the top, and when it goes out, it is taken from the top.

The stack model can be applied

to all blockchains both UTXO and account-based. And unlike the canonical coin

age model for UTXO-based blockchains, it actually has some economic meaning.

The stack model can be applied

to all blockchains both UTXO and account-based. And unlike the canonical coin

age model for UTXO-based blockchains, it actually has some economic meaning.

In economics, money supply is split into different types: M0, M1, M2, M3 and M4, according to their liquidity. M0 are all coins and notes in circulation, M1 includes assets that are easily convertible to coins and notes, M2 includes short-term deposits and M3 includes longer-term deposits.

We don't yet have Bitcoin or Ethereum deposits but we still have coins that are more liquid and others that are less liquid. We can have a single address that holds large quantities of ETH, but the transactions that it is a part of are all for relatively small amounts. This scenario is very common for exchange wallets. It would be good to be able to split the money in such addresses in more liquid and less liquid segments. The stack coin age model allows us to do just that.

Let's see how our model compares to Bitcoin's canonical model. One simple way to compare the two is to compute a metric using both models and contrast the resulting values. Here is the comparison between our own stack-based realized cap and the original metric:

You can see that the values of the two metrics are almost the same.

The reason for this uncanny similarity is actually quite simple most Bitcoin addresses are used only for a single output. More precisely at the time of writing there are around 473 million different addresses in the Bitcoin blockchain, and of those about 411 million (or about 87%) are used for only two transactions one incoming and one outgoing. For these addresses any two reasonable coin age models would produce the same ages.

There are however some areas of the chart where the stack-based realized cap is slightly lower than the utxo-based metric. We do not yet understand the significance of the difference between the two different realized cap measures and why the stack-based metric is always lower than the UTXO-based one.

Acknowledgments

The stack coin age model was first developed at the end of 2017 by Michail Lopatchouk from IBA. Maksim, Santiment's founder and CEO, had asked him if it is possible to develop an Ethereum and ERC20 equivalent to the Bitcoin-days destroyed metric. Milan, Tzanko and Valentin from Santiment optimized the calculations and used the model to create Ethereum equivalents for age distribution and realized cap.

References

Akiron. “Bitcoin Days Destroyed.” bitcoin days destroyed.

Bansal, Dhruv. “Bitcoin Data Science (Pt. 1): HODL Waves.” hodl waves.

Carter, Nic. “Bitcoin Honeybadger 2018 Bitcoin Conference, Riga, Day 2.” bitcoin honeybadged 2018.

Carter, Nic, Antoine Le Calvez, and Coinmetrics team. 2018. “Introducing Realized Capitalization.” 2018. introducing realized capitalization.

Coinmetrics. “Data Downloads - Coin Metrics.” coinmetrics.

/u/jratcliff63367. “An Area Chart Showing the Distribution of Bitcoins Based on Age of Last Use Throughout History.” bitcoin age distribution.